Despite persisting economic headwinds, many consumers globally are choosing to spend their money rather than save, with savings ratios declining to near pre-pandemic rates in 2023. Across various categories of non-essential spending, one quarter of global consumers on average say they will increase their spending over the next 12 months, according to Euromonitor International’s Voice of the Consumer: Lifestyles Survey (fielded January to February 2023). Younger consumers particularly enjoy spending their money rather than saving it and are more likely to indulge in luxury products compared to older consumers. This behaviour can likely be attributed to a shift away from traditional milestone purchases of buying a home, a car, or raising a family, and redirecting spending to other types of premium purchases. The definition of premiumisation is expanding and an increasing number of industries, products, and services will continue to evolve to make premium more accessible for consumers.

Sources: Euromonitor International from national statistics; Euromonitor International Voice of the Consumer: Lifestyles Survey, fielded January to February 2023

Premiumisation is becoming increasingly accessible

While premiumisation trends are manifesting across industries, there are innovations in food and beverage, fashion, and travel, setting lower barriers of entry to premium experiences.

The tension between desire to spend, along with financial concern, is breeding new opportunities in premiumisation across industries, which is reflected in the anticipated growth in premiumisation as a trend between 2022-2032 across global regions.

Unique partnerships in food and beverage provide access to luxury experiences

Recently, especially in the US, there has been an abundance of snack brands being paired with a high-end product or brand to bring luxury to a wider audience, and in a familiar way. One example is Caviar Co and its recent snack box launch in collaboration with Pringles, a widely accepted US salty snack brand. Although the snack box is priced at a premium price point (USD140), it is a more affordable and familiar option compared to the alternative of finding and purchasing caviar in a high-end store or restaurant.

Source: www.thecaviarco.com/

Similarly, there has been a social media craze of pairing potato chips with different wines for a unique flavour fusion, which levels the playing field for those interested in wine but are uncertain of how to approach it.

These examples of new partnerships demonstrate how the food and beverage industry is allowing consumers to feel connected to luxury, even in smaller ways, ultimately to make the experience feel more attainable to encourage future purchases.

Segmentation of premium in the fashion industry

From building new brand lines out of iconic names in the industry, to creating an entirely new luxury segment, fashion companies are finding ways to bridge the gap between premium and affordable options consumers feel good about purchasing.

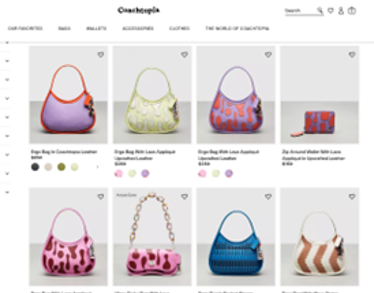

Coach is a strong example of affordable luxury, as it recently launched a more affordable brand segment targeting younger consumers, called Coachtopia. This brand is at a lower price point compared to its original Coach brand, yet boasts the use of sustainable materials and brighter colours to draw a more premium angle to the brand despite costing less.

Source: www.coach.com

Another example lives within the newer segment of luxury fashion – the resale market. Companies such as Vestiaire originally led this movement by making high fashion brands more affordable. Today, companies are arising regularly to cater for the growing consumer demand for used luxury products at a discounted price. An example out of Italy, Lampoo is a resale designer fashion platform that has gained momentum over the last few years, popularising second-hand luxury products over buying new.

Finding affordable luxury in travel

The travel industry has also been gaining significant attention recently for more affordable, yet luxurious, travel destinations. New business models along with existing platforms have been creating new opportunities for consumers to experience luxury, without the hefty price tag.

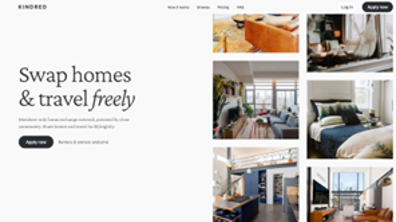

A clear example from the US is Kindred, a house swapping platform that allows consumers across North and Central American cities, including New York City, Los Angeles, and Mexico City, to essentially trade living arrangements for no additional cost. Acting as more of a barter system, consumers can enjoy premium experiences without worrying about how to afford them.

Source: www.livekindred.com

Another example is Elsewhere by Lonely Planet. Through an acquisition back in 2022, the US travel company Elsewhere became part of Australia’s Lonely Planet family, bringing more unique travel experiences to consumers. The company pairs consumers with local guides to help develop a travel itinerary and access the most authentic travel experiences. Accessing premium, one-of-a-kind opportunities has become a reality for travellers globally through the merging of these two travel platforms.

Unlocking premium potential: Strategies for captivating consumers beyond price

These examples demonstrate the effort across industries to reach new consumers and reinvent what luxury and premium looks like, as financial situations change and evolve alongside consumers’ lifestyle choices and preferences.

Looking ahead, premiumisation will continue to flourish and manifest in new ways globally. For businesses to act on these opportunities, they will need to keep the following in mind:

- Think outside the box – explore new avenues to entice consumers with more premium offerings, from business models to partnerships.

- Ensure you are bringing the right price point to the right consumer audience – consumers across ages, income levels, and geographies seek premium products, services, and experiences. Tailoring offerings accordingly will be increasingly important.

- Maintain a strong understanding of consumer values beyond price – experiences, sustainability, and convenience are all important values to consider to make a product feel more premium to consumers.

For further information on Premiumisation, download our report Megatrends: Premiumisation.